Unnecessary Us citizens have a problem with debt. A survey presented from the Hometap for the 2019 of almost 700 You.S. residents revealed that even though many people are house-rich, they are also cash-poor, with little time-to-date exchangeability. Survey takers conveyed when they did has financial obligation-free access to the house’s collateral, such as for instance a home collateral improve, that they had utilize it to repay credit card debt, scientific expenses, if not let family and friends pay off loans.

Of many people responded which they have not also thought options available in order to tap into their house guarantee. In a nutshell, they think caught given that readily available financial alternatives only apparently include a whole lot more debt and appeal into the homeowner’s month-to-month equilibrium sheet sets. There is the situation out-of certification and you will approval, because it’s tough to be considered of numerous financing selection, like a house security financing, that have less than perfect credit.

The good thing? So it household rich, bucks bad status quo doesn’t have to keep. Here, become familiar with regarding requirement for credit, and just how you can however availableness your property equity if the your very own was less than perfect.

What is Borrowing and exactly why Can it Count to help you Loan providers?

Borrowing refers to the power to to borrow funds, get affairs, otherwise use services whenever you are agreeing to incorporate percentage at a later date. The expression credit rating refers to an effective three-digit count one suggests the amount of sincerity you’ve showed during the going back as a consequence of experience with financial institutions, lenders – fundamentally, any business that has provided you money. This article is attained for the a credit report because of an option of various source, such as the quantity of playing cards you really have, plus people the balance on it, the reputation for financing and you may fees choices, timeliness out of payment commission, and significant trouble for example bankruptcies and you may foreclosure.

Put differently, lenders wish to be as sure to that you’ll pay straight back any cash they give you to you personally, and you can checking their borrowing from the bank is a simple and you can relatively total means to gather this short article.

While you are carrying a good amount of loans and therefore are worried about your credit, you could think that your household equity try unreachable. But with a special, non-financial obligation investment choice available to various residents, you may be astonished at what you can access. Here are some ways you can make use of your house collateral first off having fun with that liquidity to reach your financial requires. ?

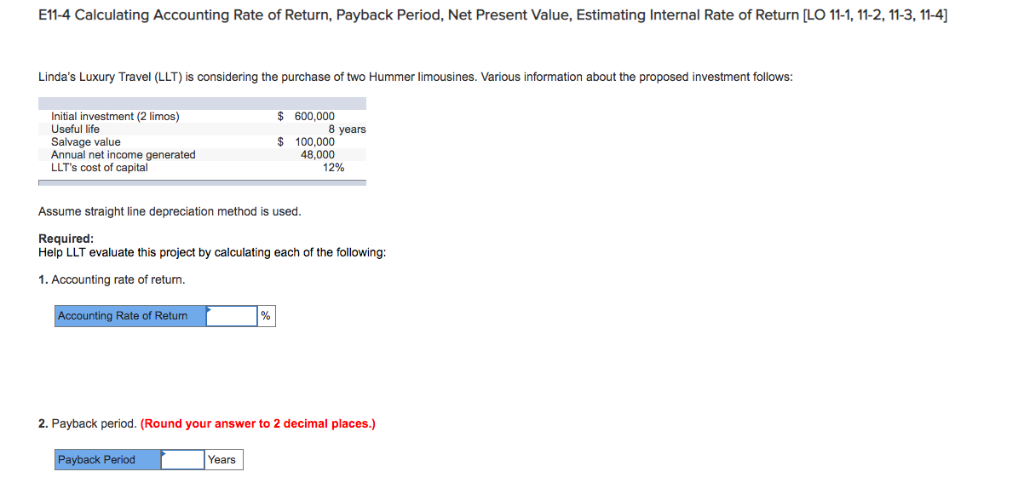

Understand the graph lower than for a quick writeup on your options that could be on the market considering your credit score, then continue reading for more inside-depth meanings of each.

Cash-Away Re-finance

A finances-aside refinance occurs when your, the latest resident, take-out an alternative, huge financial, pay back your financial, and use the additional to fund your circumstances. This can be done via your existing lender otherwise a special financial which can be maybe not considered one minute financial. According to Bankrate , your generally you desire about 20% security on your assets to meet the requirements, and you’ll shell out attention on lifetime of the borrowed funds (constantly fifteen or three decades). By enough time time of a finances-out refi (while the they truly are also called), you need to guarantee the interest rate and your expected cost package fit into your own monthly budget. Residents are generally expected to has actually a credit score minimum of 620 to be accepted to have a cash-away re-finance.

Family Equity Mortgage or Domestic Collateral Line of credit

Would you be eligible for a house security loan otherwise property security personal line of credit (HELOC) having less than perfect credit? Very first, you have to know the essential difference between these family security choice.

A house security mortgage enables you to borrow cash utilising the guarantee in your home because the security. A good HELOC, as well, works more like a credit card, in the same manner that you can mark cash on a concerning-called for foundation. Which have both household security fund and you may HELOCs, your credit score and home guarantee value will have an associate in the manner much you’ll obtain as well as your notice rate.

Minimal credit rating needed for a property equity mortgage and you will a great HELOC are about 620, although it hinges on the financial institution. However, even although you cannot satisfy which lowest credit score having a home equity mortgage or HELOC, don’t be discouraged. Julia Ingall which have Investopedia says home owners that have bad credit will be testing go shopping for lenders offered to handling consumers such as for instance him or her. Additionally, Ingall cards one to coping with a mortgage broker can help you take a look loans in Branford Center at your alternatives and make it easier to credible loan providers.

Domestic Security Improve

A house guarantee progress offers residents the capacity to tap into the near future worth of their property to access their equity now. Property collateral financial support are an easy way to-do merely one.

Within Hometap, residents is discovered family equity investments to enable them to explore a few of the security they usually have amassed in their home to complete almost every other financial requires . The new homeowner becomes cash without the need to offer and take out financing; as there are zero attention with no payment. . Some other advantage regarding a Hometap Capital is the fact a huge selection of items try considered in order to approve a candidate – credit rating isn’t the identifying expectations.

Sell Your property

For some, it’s a last resort, but people with less than perfect credit have access to their home’s equity because of the offering they outright. However, that it choice is actually predicated upon finding a more affordable home to possess your next household, plus positive mortgage terminology for your the latest place, and you can making certain that you do not purchase too-much on a property costs otherwise moving can cost you. you could possibly improve your credit rating in advance of you reach this aspect. Monitoring your credit rating to keep a watch away to have prospective disputes and you will discrepancies, maintaining an equilibrium really under your credit limit, and you may remaining dated levels discover are a beneficial cities to begin with.

When you are perception household-steeped and cash-worst for example way too many People in america , you’ve got a number of choices to availability your property guarantee. As with any major financing choice, speak with a reliable financial elite to decide the best movement out-of step, and also have moving with the your goals.

We would the best to ensure that everything in the this post is as accurate that one can as of the newest big date its typed, but some thing changes quickly possibly. Hometap cannot promote otherwise monitor people connected websites. Private issues disagree, therefore consult your own loans, tax or lawyer to determine what is practical to you.